Reduce Your Taxable Income By

$400K

By Purchasing an Income-Producing Luxury Hospitality Asset.

Have you ever dreamed of writing off all your taxes and buying a luxurious Vacation rental that produces you a postive income stream and allows you to enjoy it anytime you want?

Well… now you can!

Tired of Losing Hard Earned Income to Taxes?

We help high-income professionals and business owners convert tax payments into tangible, income-generating assets — while qualifying for full federal deductions under Sections 179 and 168(k) of the IRS code.

Reduce tax liability

Own real assets

Create monthly income

Signature Houses Qualify For A Unique Tax Designation

This is an opportunity to reduce your taxable income by $400,000 with a one-time $100,000 investment into an income-producing tiny home.

Summary

Due to its unique designation as a business property, the Signature House qualifies for a one-year, 100% deduction as defined under the Internal Revenue Code, section 179. For tax years beginning in 2025, the maximum expense deduction is $1,250,000. (Larger amounts can be deducted under IRC 168k)

A taxpayer puts a one-time $100,000 down payment toward the purchase of a tiny home, which is subject to a cashflow buyout lease with a remaining $300,000 per unit payable out of future cash flow.

Let's look at the transaction process.

One-Time Down Payment

With a one-time down payment of $100,000, the taxpayer acquires ownership of a Signature -Timber House for $400,000.

Purchase Details

Purchase an income-producing Signature -Timber House for $400,000 with $100,000 down. The remaining $300,000 will be financed by Southern Cross Capital with 5% interest over 25 years, resulting in a monthly payment of $750.

Lease Agreement

The acquisition comes with a lease in place to a qualified lessee who places end users into the homes. The lessee agrees to pay the $300,000 mortgage owed under the financing terms over 300 months. (25 years)

Signature House manufactures and sells these tiny homes on payment terms described above and keeps a security interest until the final payment is made.

Details

Signature Hospitality leases your Signature -Timber House units for $1,250 per month over a 25-year term. They cover the $750.00 monthly loan payment and return the $500.00 difference to the investor each month.

Tax Deduction

Under IRC 179 an owner may take a $400,000 deduction against their 2025 taxable income.

Section 179

The amount of expense write off available in 2025 is 100% of the basis of the asset placed into service in 2025. While real estate is not eligible under section 179, IRS rulings have concluded that when a structure is movable (such as with a wheeled trailer) these portable homes are delivered on wheels and can be readily transported, and are therefore considered business property, not real estate.

Expense Write-off

Section 179 is a deduction that allows the tax payer to write off the cost of qualified property or equipment as an expense, during the first year it was purchased and placed into service. Compared to section 168, which tax payers use to write-off a portion of the depreciation over 5 years, section 179 gives the tax payer the ability to deduct the entire cost in a single year.

Frequently Asked Questions

FAQ´s

-

Section 179 of the U.S. internal revenue code is an immediate expense deduction that business owners can take for purchases of depreciable business equipment instead of capitalizing and depreciating the asset over time.

-

The maximum Section 179 deductions a tax payer can claim in 2025 tax year $1,250,000.

-

Placed into service means the moment when a piece of property is ready and available for a specific use.

Typical Timber House Scenario

John is a skilled surgeon. At 56 years old, John is seeking ways to optimize his financial situation and reduce his tax liability. Let’s explore how he can leverage the TimberHouse program to his advantage.

John’s annual income as a surgeon stands at $800,000. John currently has a tax rate of 37% and is now subject to a tax obligation of $254,187. John would like to reduce his tax obligation. He is now the perfect candidate for the TimberHouse Tax Mitigation program.

Let’s illustrate the specifics of John’s tax-saving plan using Section 179 of the US tax code.

John plans to purchase a TimberHouse for $400,000. To secure the home, a purchase agreement is completed wherein John provides a down payment of $100,000.

The balance now owed is $300,000. This acquisition comes with a lease in place to a qualified lessee who places an end user in the home. The lessee agrees to pay the remaining $300,000 owed under the financing terms over 300 months. With the lease in place John does not need to worry about making the payments.

Now, due to the unique qualifications of a TimberHouse John is able to deduct 100% of his tiny-home purchase in the first year by applying section 179 of the US tax code.

This unique purchase combination provides John with a substantial deduction which decreases his tax obligation.

Here is an example of how John’s tax obligation can be reduced by purchasing a TimberHouse using Section 179.

*John is a single filer

Mirror Home

High-design glamping unit with mirrored glass and premium interiors, ideal for boutique hospitality experiences.

The Models

A-Frame Studio

Modern park model cabin with luxury finishes, perfect for short-term rentals and 100% tax deductible.

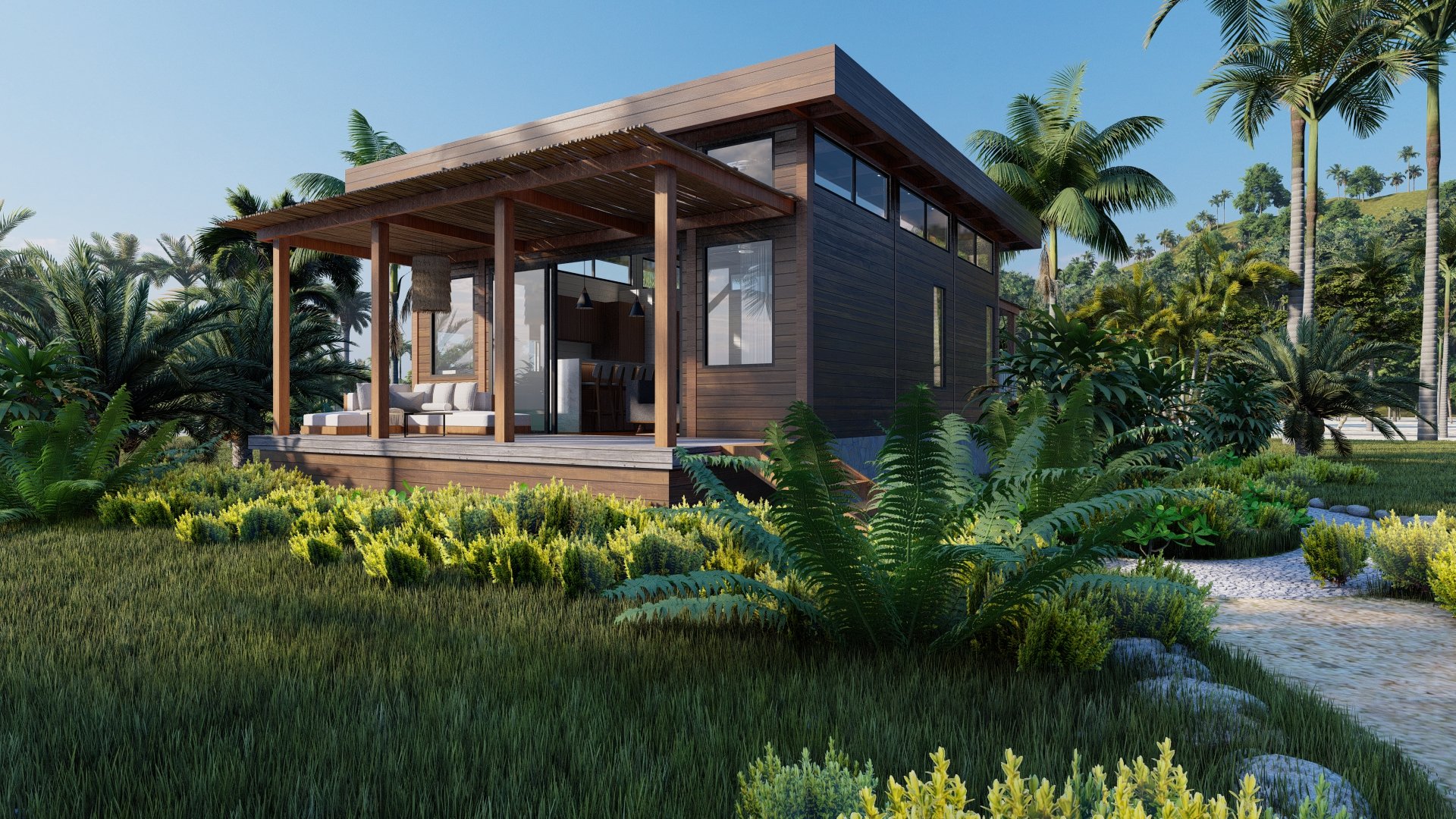

TimberHouse

Wood-framed movable home with full amenities, built for durability, mobility, and maximum tax efficiency.

Wellness Pods, Pools & Saunas

Compact spa-style units that enhance guest experience and qualify as fully deductible, income-producing assets.

Why the Luxury Vacation Market?

A High-Demand, Vacation-Rich Region

Located in some of the nation’s most popular Vacation destinations, waterfront & mountain locations have a strong demand for the short-term Luxury vacation rental market, driven by economic growth and tourist demands. SigntureHouse places you at the center of this high-demand marketplace.

Where are the tiny-homes installed?

The majority of homes are currently being installed in RV Parks in tourist-friendly regions across the United States, including Texas, Florida, Tennessee, North Carolina, and Arizona, where demand for short-term rentals and outdoor hospitality is high.

Financing Terms

Purchase Price: $400,000

Down Payment: $100,000

Note Balance: $300,000

Note Rate: 5%

Note Term: 25 Years

Monthly Note Payment: $750.00

Lease Payment to Tax Investor: $1,250

$500 payment to the Investor monthly = 6% ROI + Tax Savings

*Balloon Payment at 15 Years $150,000

Signature Houses Qualify For A Unique Tax Designation

Signature Houses Qualify For A Unique Tax Designation

As a moveable tiny home structure, SignatureHouses qualifies for a one-year, 100% deduction as defined under the Internal Revenue Code, section 179. For tax years beginning in 2024, the maximum expense deduction is $1,220,000. (Larger amounts can be deducted under IRC 168k)

Section 179

In 2024, Section 179 allows businesses to write off 100% of the cost of qualifying assets in the year they are placed into service up to $1,220,000. While real estate does not qualify, IRS rulings have determined that movable structures, such as portable homes delivered on wheels and used to produce income, are considered personal property and not real estate. This classification makes SignatureHouses eligible for Section 179 deductions.

Section 168(k) – Bonus Depreciation

In 2024, businesses can deduct 68% of the asset’s cost in the first year, with the remaining 32% spread over the following four years. Movable structures like SignatureHouse units, which are delivered on wheels and can be transported, are classified as personal property under Section 168(k), making them eligible for this bonus depreciation.

Flexible exit strategies to maximize savings

You have flexible exit strategies take control over your investment’s future.

Donate your Signature House to a charity, transfer income rights, or explore other options to maximize your impact and potential tax benefits.

References

1. https://boxhouse.com/legalopinion.pdf

2. Basis is the amount of your capital investment in property for tax purposes. Use your basis to figure depreciation, amortization, depletion, casualty losses, and any gain or loss on the sale, exchange, or other disposition of the property. The basis of an asset is its cost to you. The cost is the amount you pay for it in cash, debt obligations, and other property or services. See https://www.irs.gov/taxtopics

3. Borrowed cash is full basis, untaxed money in the borrower’s hands. These funds may be used to purchase assets with a full-cost basis that enables the financier to earn profits and suffer losses in operating or disposing of the assets. If the debt is genuine and reasonable in terms of the fair market value of the purchased property, the full amount of borrowed funds generally gives rise to cost basis. See: https://www.thetaxadviser.com/issues

4. There is no need to discount a note receivable to the present value when determining tax basis. See Peracchi, Donald

J. et ux v. Commissioner where a 10-year note at 11% interest was held to contribute the full face value to the calculation of basis: https://www.taxnotes.com/research/federal

5. See Uniform Commercial Code §1-203. Lease Distinguished from Security Interest.

a. Whether a transaction in the form of a lease creates a lease or security interest is determined by the facts of each case.

b. A transaction in the form of a lease creates a security interest if the consideration that the lessee is to pay the lessor for the right to possession and use of the goods is an obligation for the term of the lease and is not subject to termination by the lessee, and: (1) the original term of the lease is equal to or greater than the remaining economic life of the goods; (2) the lessee is bound to renew the lease for the remaining economic life of the goods or is bound to become the owner of the goods; (3) the lessee has an option to renew the lease for the remaining economic life of the goods for no additional consideration or for nominal additional consideration upon compliance with the lease agreement; or (4) the lessee has an option to become the owner of the goods for no additional consideration or for nominal additional consideration upon compliance with the lease agreement.

6. This is based on our suggested use/exit. As the direct owner and manager of this equipment, the financier can modify the program to include renegotiating the buyout lease or any other element of the program. Nothing herein is intended to constitute a security nor to suggest that the financier is in any way a passive party to the transaction. Each transaction is entered into on a stand-alone basis, and there is no pooling arrangement.

7. https://www.irs.gov/publications/p946

Disclaimer

Tax Investor and its affiliates do not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any transaction.