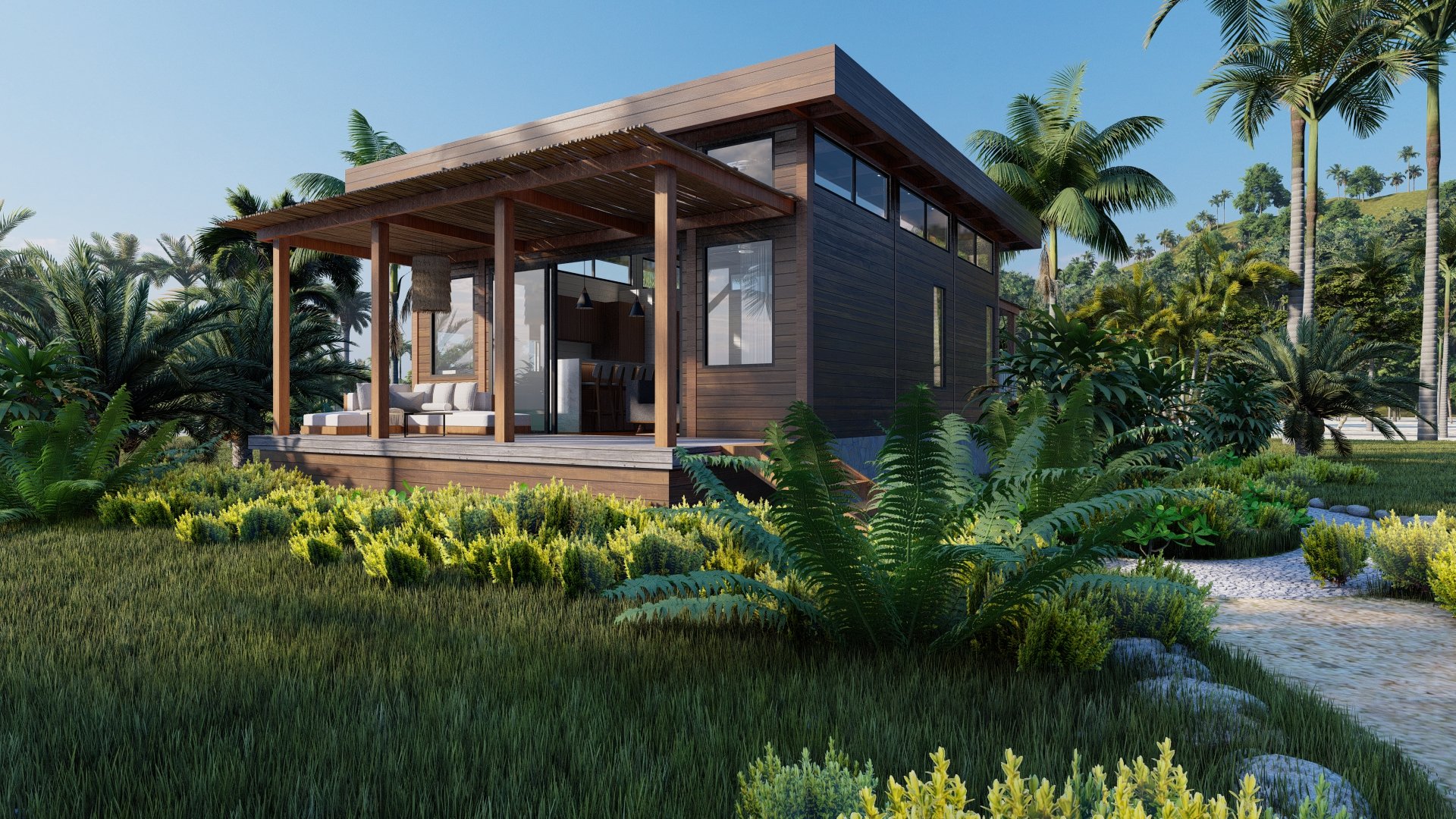

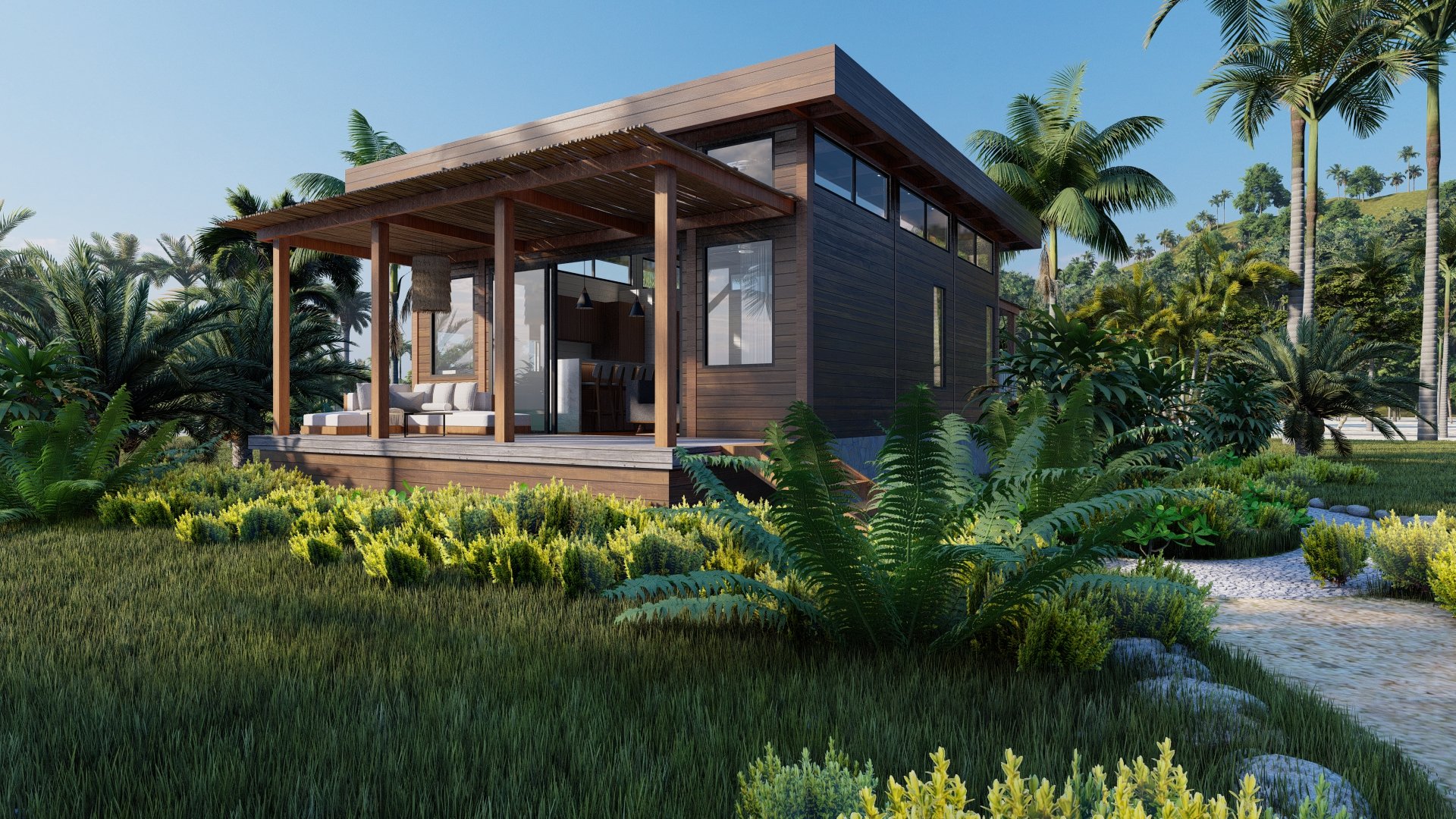

The Timber Frame Houses

The TIMBERHouse is a rugged, movable 380 sq.ft. housing unit designed for privacy, comfort, and longevity — making it the ideal income-generating asset for real estate investors, business owners, and hospitality developers.

Engineered with a full steel frame and weather-resistant walls, the TIMBERHouse is built to outperform traditional wood-framed structures in terms of durability, setup speed, and long-term maintenance. Whether used on private land or as part of a resort expansion, it qualifies for a 100% first-year tax deduction under IRS Section 179, making it one of the most powerful tools in real estate-based tax planning.

Built Strong. Built Smart.

The TIMBERHouse includes a full bathroom, private bedroom, modern kitchen, and combined dining/living space — everything a guest needs, in a structure that’s more efficient to own and operate than any conventional build.

Steel frame and walls for long-term durability

Sits on 12 adjustable feet — no foundation required

Delivered ready-to-install with minimal site prep

Designed for privacy and comfort

Can be relocated or resold as needed

100% first-year tax deduction

Deduct the full purchase price in year one, maximizing savings and reducing your taxable income immediately.

Investment Highlights

Only 25% down payment required

Secure your investment with minimal capital outlay — just 25% upfront to activate full ownership benefits.

Positive monthly cash flow

Enjoy net monthly income from day one with fully leased, income-generating units managed by hospitality partners.

Tangible, mobile, and resellable asset

Perfect for integration in hospitality developments or as a standalone investment

Technical Specs

Total Area

~380 sq.ft.

Dimensions

16 ft x 25 ft

Structure

Steel frame and weather-resistant walls for superior durability

Foundation

No foundation needed — sits on 12 adjustable feet over concrete blocks or helical piers

Interior

Includes bedroom, full bathroom, kitchen, dining and living space

Mobility

Movable structure, ideal for repositioning or resale

Use Case

Short-term rental, guest suite, or hospitality expansion

Tax Deduction

Fully eligible for Section 179 deduction in Year 1

($375,000 deductible value = up to $135,000 in federal tax savings)